How Korea’s Cashless Society Is Moving Faster Than the US

You know that feeling when you step out with nothing but your phone and feel strangely… lighter? That’s daily life in Korea right now, and it sneaks up on you in the best way요. The coffee kiosk recognizes your mobile wallet in a blink, the bus reads your phone like it’s been friends forever, and splitting dinner is a two-tap bank transfer that lands instantly다. If you’ve wondered why Korea got here faster than the US, you’re in the right place—grab a seat, I’ve got stories and numbers to back them up요 🙂

What cashless really looks like in Korea

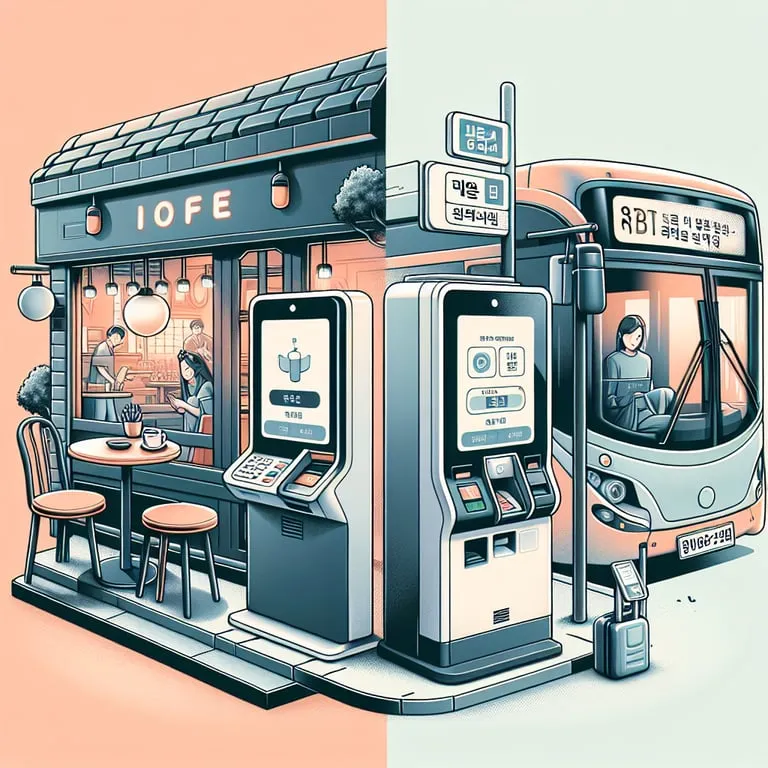

Tap-first life in the wild

Walk around Seoul and you’ll see the practical magic everywhere요. Nearly every reader takes tap, from convenience stores to tiny market stalls, and even vending machines, parking meters, and laundromats play nicely with phones다. The flow feels uniform: bring phone close, get haptic buzz, done요. No pin-pad confusion, no “dip then swipe” dance, no “try again” sighs다.

Public transit keeps it seamless요. T-money and Cashbee ride in your phone or on a slim card, and gates open without skipping a beat다. Taxis? Tap-and-go. Street food? QR or mobile wallet요. It’s rare to hit a dead end where plastic or phone won’t work다. Honestly, even cash-based corners have thinned out a lot요.

The numbers behind the habit

As of 2025, cash’s share of everyday consumer transactions in Korea sits comfortably in the single digits by volume요. For in-store payments, the vast majority are contactless—think nine out of ten taps, not five out of ten다. Smartphone penetration hovers in the mid-to-high 90% range among adults, which means mobile wallets are not just installed—they’re used daily요.

- Kakao Pay, Naver Pay, Samsung Pay, Toss—these are everyday verbs, not just apps다.

- Card usage per person is high by global standards, with hundreds of electronic transactions per adult per year요.

- A meaningful slice rides on bank transfers, not only card rails다.

The net effect: getting through a week without touching cash isn’t just doable—it’s common요.

Beyond cards: bank transfers as payments

Here’s a uniquely Korean twist: paying with bank transfers at the register or to a merchant’s “virtual account” is normal요. Instant A2A (account-to-account) payments are free or close to it for consumers, and ubiquitous for P2P, bill pay, and business invoices다. In a pinch, a shop will show a QR or an account number; you send, they receive in seconds, and everyone moves on요. No waiting windows, no batch files, no “we’ll post it tomorrow” footnote다.

A quiet policy backbone

Under the hood, a policy stack keeps incentives aligned요. Interchange and merchant discount rates are regulated and stepped by merchant size, compressing costs for small businesses다. ZeroPay (a QR-based alternative) can bring merchant fees near 0–0.5% for eligible small retailers, versus 1–2%+ on traditional cards요. Tax policy sweetens the pot too—electronic receipts, income tax deductions on qualifying card/QR spend, and standardized e-invoicing push the ecosystem toward traceable, digital rails다. It’s not flashy, but it’s effective요.

Why the US trails even with great tech

Fragmented rails and incentives

The US has excellent fintechs and world-class card networks요. But rails are fragmented at checkout다. You’ve got cards (with EMV, magstripe, NFC), multiple P2P networks (Zelle, Venmo, Cash App), and now two instant payment systems (RTP and FedNow) that still don’t meet you at the point of sale요. Consumers default to what terminals accept quickly: cards다. A2A lives mostly in P2P and bill pay, not in-store요.

Fees that shape behavior

Merchant fees are destiny다. US credit card acceptance typically costs small merchants 2–3% all-in, which pushes cash discounts, minimums, or “we prefer debit” signs요. There’s no nationwide cap on credit interchange, and debit caps apply unevenly다. In Korea, the fee curve is flatter for tiny merchants, and QR-based acceptance can be near-zero요. When acceptance is cheaper and simpler, adoption accelerates—funny how that works, right? ^^다.

Patchwork rules and cash mandates

Several US cities require businesses to accept cash요. Consumer protection logic is sound, but operationally it slows fully cashless momentum다. Meanwhile, card-present tech isn’t uniform: some terminals don’t enable tap by default, and PIN prompts and fallback flows vary widely요. That friction adds up in queues, and it shapes habits다.

Culture and geography

The US is huge, diverse, and less dense요. Ultra-dense cities are fertile ground for uniform tech rollouts; suburban and rural America is a different story다. Add tipping norms, legacy POS contracts, and the sheer variety of merchants, and transitions take longer요. Korea benefits from a tighter loop among regulators, issuers, acquirers, platforms, and consumers다.

The rails under the hood

24/7 instant as the default

In Korea, moving money account-to-account is instant, 24/7, and reliable요. It’s not a novelty—it’s the floor다. Transfers clear in seconds, not hours or days, and they’re priced for everyday use요. That makes A2A a real substitute for cards in many contexts다.

Open banking that actually opens doors

API-based access lets fintechs query balances, initiate payments, and verify accounts with user consent요. Onboarding a new money app? Most users finish in minutes다. The practical win: merchants can initiate instant pull payments with strong authentication, avoiding high card fees요.

Identity and e-KYC as a feature

Korea’s e-KYC fabric is tight요. Telecom-based identity (e.g., PASS), joint certificates, and biometric auth give near-frictionless strong customer authentication다. Users see simple, consistent prompts—face, fingerprint, short passcodes—and they’re done요. It makes “secure” feel fast instead of fussy다.

Security UX that doesn’t get in the way

Fraud controls are layered where they matter요. First-time payees may trigger brief transfer delays or name/number mismatch warnings, and high-risk flows add step-up authentication다. Banks and wallets share data signals and use behavioral ML to spot anomalies요. The vibe is “safe by default” without killing speed다.

Merchants, margins, and model choices

ZeroPay and the SMB math

For small merchants, 2–3% fees can be the difference between profit and pain요. Korea’s QR acceptance via ZeroPay cuts that dramatically다. Combine that with low-cost A2A at checkout, and even mom-and-pop shops find digital attractive요. In the US, similar economics require bank-backed pay-by-bank to be turnkey at POS, which isn’t the norm yet다.

Acceptance nearly everywhere

Hardware isn’t the blocker in Korea요. Terminals are NFC-ready, mobile readers are common, and QR is the universal fallback다. Online? One-click through native wallets, saved cards, or account-to-account happens in seconds요. Cart conversion benefits from short, predictable flows다.

Checkout UX that ends in three taps

Good flows end quickly요. In Korea, checkout tends to be 2–3 taps + biometric, full stop다. Autocomplete, masked credentials, and tokenized cards are the default요. The US is catching up fast online but still inconsistent in-store, especially with legacy terminals다.

Chargebacks and risk distribution

Card chargebacks are a risk vector merchants price into fees요. Account-to-account reversals are rarer and governed differently다. Korea’s mix of low-fee QR/A2A and regulated card fees keeps merchant risk and cost predictable요. Predictability accelerates adoption다.

What’s next in 2025

Retail CBDC pilots and tokenized deposits

As of 2025, Korea is experimenting with central bank digital currency components and tokenized bank money in controlled pilots요. Don’t expect a public CBDC switch overnight—but expect rails that make settlement faster, smarter, and more programmable다. Think conditional payments, atomic delivery-versus-payment, and fine-grained compliance baked in요.

QR interoperability and tourism flows

Regional QR interoperability is expanding요. The practical win: a Korean traveler taps or scans abroad and pays from a familiar wallet at good FX rates다. Likewise, visitors pay in Korea without scrambling for local cards or cash요. Cross-border embedded FX inside wallets is getting slicker, and that’s great for merchants too다.

Unattended commerce and embedded finance

Unmanned convenience stores, smart kiosks, and in-app ordering are multiplying요. Retail is leaning into low-touch fulfillment: scan, grab, go다. Financing sneaks in contextually—split-pay at checkout for a coffee machine isn’t weird anymore요. Tokenized credentials and network tokens keep it safe다.

The last mile for inclusion

Even in a hyper-digital market, inclusion matters요. Aging populations, rural areas, and workers on the margins need hybrid options다. Expect simplified feature phones with wallet support, cash-in/out at convenience stores, and stronger consumer protections against scams요. A society is only as cashless as its most vulnerable can handle다.

Practical lessons the US can borrow

Lower the cost of acceptance

Cost drives adoption요. Grow low-fee acceptance with standardized QR, better debit routing, and turnkey pay-by-bank at POS다. Compress fees for the smallest merchants first—it unlocks a lot of long tail volume요.

Make instant the default, safely

Instant rails are powerful when they’re predictable요. Normalize 24/7 settlement with built-in name matching, cooling-off for new payees, and transparent refund flows다. Consumers shouldn’t have to learn the plumbing to trust it요.

Normalize account-to-account at retail

Bring A2A to the counter with a uniform spec: tap or scan, biometric, done다. If consumers can use one muscle memory everywhere, they will요. Don’t strand instant payments in P2P-only land다.

Align carrots with guardrails

Incentives work요. Offer tax credits on digital receipts, publish clear fee benchmarks, and co-fund migration for SMB hardware다. Pair carrots with anti-fraud guardrails so trust scales with usage요.

The bottom line

Korea didn’t “skip” cash by accident—it systematically made digital faster, cheaper, and easier than the alternatives요. The US has the tech, the talent, and the rails, but incentives and consistency lag다. Get those right, and the experience people already love in apps will finally meet them at the counter요. When the easiest thing is also the cheapest and the safest, behavior follows—every time다.

If you’ve ever tapped onto a subway, paid a street vendor with a scan, and split a tab in five seconds, you already know how good this can feel요. The rest is just building it so everyone gets to feel that way, every day다.

답글 남기기